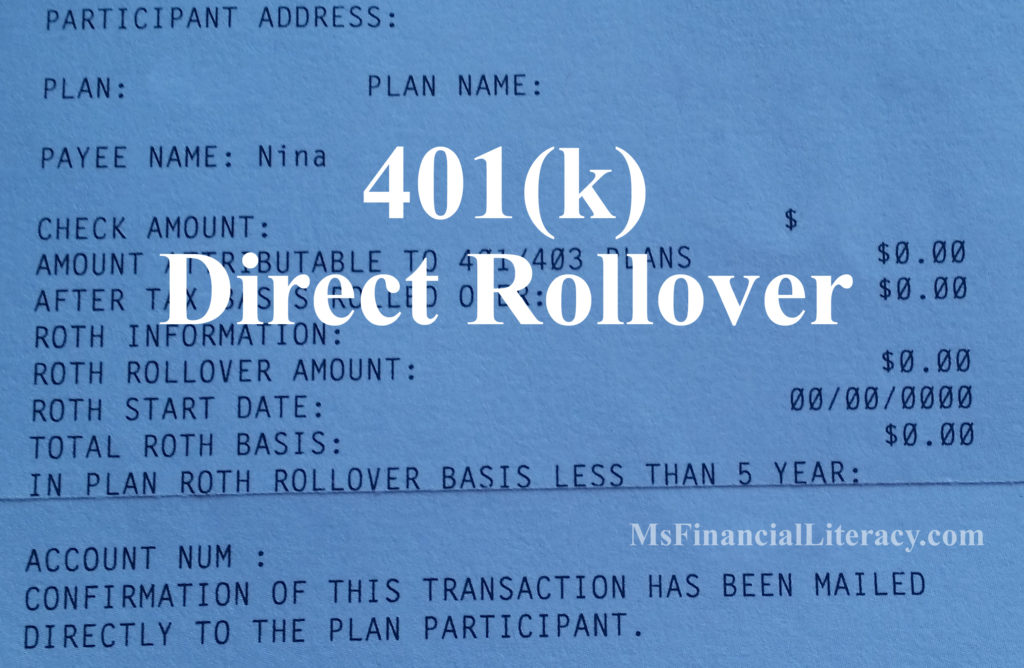

When I left my previous employment in early March 2017, I was eager to do a 401(k) direct rollover as soon as possible. In an earlier article, I shared that my 401(k) plan charged relatively high fees. I was also excited to have more control over my investment options. In this article, I’m sharing my experiences doing a 401(k) direct rollover to a traditional IRA. I hope you’ll find this article useful as you go on to learn what’s financially possible for you. I also wrote two comprehensive articles on 401(k) here and here if you’re interested in reading additional materials.

With a direct rollover, the funds are transferred directly from your 401(k) plan to your IRA custodian (or brokerage) and you will not pay an early withdrawal penalty or taxes. The check for the funds is made out to your IRA custodian, not you. For this reason, when you’re ready to do a 401(k) rollover, be sure you’ve already set up a traditional IRA account with the custodian of your choice. Then, when you speak with your previous employer and/or 401(k) plan administrator, be sure to let them know you’re doing a direct rollover and that the check won’t be made out to your name. If the check does get made out to your name, you might have to face taxes consequences immediately. Although you’ll be getting that money back after you filed your tax return (provided you’ve done the rollover correctly and remember to do your tax return correctly), the extra paperwork and hassle are unnecessary. Avoid this while you can. In my case, the check was made “payable to (my brokerage), For the Benefit Of (FBO) of Nina”.