In this post I share with you my go-to resources for mastering the financial language as I educate myself on personal finance and financial planning. Here, I also share my sources of inspirations, too. It’s a work in progress. I’ll share additional valuable resources as I learn.

I haven’t peruse through every article or chapter on every resource. This can change once I have less obligations. Afterall, I enjoy consuming new knowledge that’s applicable to my life and that of my family’s. Personal finance happens to be one of those areas that touch every aspect of my family’s life. The good thing is I actually love learning about personal finance. To avoid information overload, I suggest you pick one or two topics that are relevant in your life at this moment and learn as much you can about those topics. Then, implement the newly acquired knowledge in your life to increase your financial well-being. After that, repeat the process.

Let me share an example. If your goal is to lower income taxes, I would do a Google search using the following keywords: “lower income tax “. Most likely, the search engine would show “reduce your taxes” or “lower your taxable income” or “ways to save on taxes”. From there, take note of the topics that keep coming up, and then visit my go-to resources to read about those topics more in depth. I usually like to consult at least two to three resources and compare information. It is our responsibility to cross check information between sources. Information listed on these websites don’t always guarantee accuracy. Do your homework diligently. This is your hard earned money we’re talking about here. As you read, pay attention to the terms and keywords/phrases, and understand the concepts well. Overtime, before you know it, you’ve joined the financial geeks community!

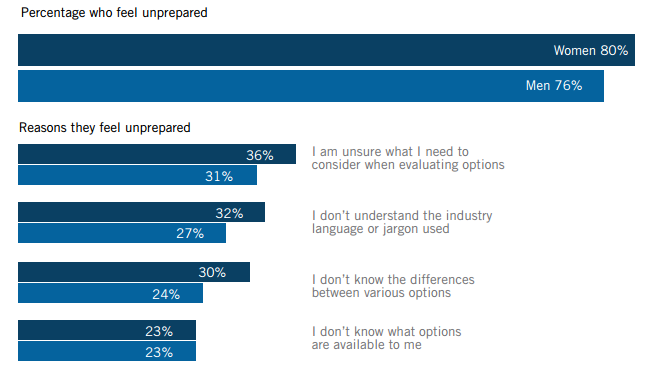

Silliness aside, I do encourage you to master the financial language. There’re many benefits. In addition to gaining sense of empowerment and boost of self-confidence, the biggest motivating factor for me has been the communication factor. When shopping for financial services and/or products, just like many areas in life, we need to know what it is we want, how to ask relevant questions and how to interpret the responses. This is where knowing the financial language gives you an advantage. You get to direct the conversation. You appear knowledgeable. You cannot be intimidated.

I chuckled the first time I learned about the term, “financial language”. I thought the people who came up with the term were too hardcore. I’ve had only associated language learning with a foreign language. However, overtime it has been becoming more and more clear to me that successful financial planning requires me to be good at reading and understanding the financial language. I don’t want to miss out on opportunities that can strengthen my family’s financial position. The convenient and well-practiced generic saying, “You didn’t ask.” (because you haven’t brought it up as a concern/interest during our previous conversations)”, is typically among CPA, financial adviser, accountant, estate lawyers and others who we pay to manage our money. Don’t be a victim to such situation anymore. Do your research so you can advocate for yourself. Those we hired to manage our money may know a lot, but they don’t necessarily always volunteer extra information that might benefit our situation. Be your own advocate! I encourage you to learn along with me and find out what’s financially possible for your unique situation. We really don’t know what we don’t know until we put in efforts and start learning.

Books

The Millionaire Next Door: My favorite chapter in this book is “Frugal Frugal Frugal”. I enjoyed reading about other people’s stories on being frugal, building wealth, raising children and being smart about leaving a legacy. The book mentioned that wealth is blind (blind to one’s level of education, blind to one’s family background). Such concepts are encouraging for me as I came from an immigrant family with very little.

Your Money or Your Life: This book discusses money/wealth as an integrate whole, not only at the personal level, but also at the societal and global levels, too. Some concepts I enjoyed reading: (1) the “Fulfillment (Enough) Curve”–optimizing one’s lifestyle reaching the peak of the curve where one experiences maximum fulfillment (anything beyond the peak won’t bring much more enjoyment), (2) the values of one’s life energy–optimizing how one allocates his/her time, energy and resources on things that really matter to the individual, and (3) on financial independence thinking.

The Behavior Gap: This book does a good job explaining herd/mob mentality (e.g., people in large groups tend to behave the same way at the same time as their peers). Here, the author specially talked about following market trends. The book is also about the importance of having a financial plan, yet, being ready to make modifications along the financial journey.

The Making of an American Capitalist: My husband gave me this book very early on in our relationship. He’s a great fan of Warren Buffett. This book encouraged him to reassess what he values and taught him how to analyze individual stocks and determine the stocks’ relative values. Similarly, the book certainly taught me how to become a better investor and make my money work harder.

Money a Love Story: This book presents similar ideas, concepts, and practical strategies that I’ll be sharing on this blog. For instance, the book touched on some of the concerns I shared on A Women’s Financial Responsibilities in Her Household (my husband pointed out this to me as we were reading together one afternoon). Interestingly, I wrote those two posts prior to having read this book. I definitely recommend this book to any women who is pursuing or wants to pursue financial security and financial independence.

Rich Dad Poor Dad: A very well written book! The messages presented are both philosophical and radical at the same time. It’s a must-read for anyone who needs a wake up call on financial literacy. The author encourages people to reevaluate their views on money. He claimed that fear and greed (a.k.a desire) tend to control the financial behaviors of those who are financially illiterate; as one’s financially literacy improves, he/she would be more likely to use the brain to make rational financial decisions.

A Room of One’s Own: This is a fiction book, the first book I read when I started on my financial journey (early year 2016). The book’s general message is that women must have a fixed income and a room of their own in order to have the freedom to create. The book was first published in 1929, during a time when sexism held back women’s intellect freedom. The author argued that in order for a women to express her creative intellect she would need to have financial freedom. Here’s an example of a powerful message from the book that resonated with me, “At the thought of all those women working year after year and finding it hard to get two thousand pounds together, and as much as they could do to get thirty thousand pounds, we burst out in scorn at the reprehensible poverty of our sex. What had our mothers been doing then that they had no wealth to leave us? …Now if she had gone into business; had become a manufacturer of artificial silk or magnate on the Stock Exchange;…If only Mrs. Seton and her mother and her mother before her had learnt the great art of making money and had left their money, like their fathers and their grandfathers before them…it was useless to ask what might have happened if Mrs. Seton and her mother and her her mother before her had amassed great wealth…in the first place, to earn money was impossible for them,…the law denied them the right to possess what money they earned,…it would have been her husband’s property…”.

Think and Grow Rich: This is a classic must-read for anyone who wants to be more and live a richer life (more than just the monetary aspect). I absolutely enjoyed reading this book. The concepts in every chapter tapped into the psychologist geek in me. Please do yourself a favor and read this book. You will be enlightened.

Smart Women Finish Rich: I read in the book that San Francisco was the author’s hometown. It would be a great honor to meet him. I’ve the feeling that he and I would have much to talk about. Even though the book was written from a male’s voice and perspective, I feel Mr. Bach really did an awesome job convincing women to take control of our financial future. His seven-step program is easy to follow, and completing the exercises can be empowering for many. My husband flattered me when he said that David Bach and I could’ve easily coauthored the book *blush blush*. We share such similar ideals when it comes to encouraging and promotion financial literacy among women. If Mr. Bach is still offering the seven-step program live, I would certainly want to listen and participate. He would have a lot to teach me as I continue on this journey inspiring and empowering other women.

Secrets of Six-Figure Women: I enjoy reading about stories of accomplished women. Stories like the ones shared in this book are inspiring. Those stories helped me realize what’s possible for me if I practice certain strategies and improve on certain traits. This book is for women who want to increase their earning potentials, and at the same time build wealth. The author helped me see that doing both are possible.

The Feminine Mistake: This book is like the modern version of Virgina Woolf’s “A Room of One’s Own”-see review above. As someone who is a mother, with great career aspirations, I enjoyed reading about the individual stories shared in this book. Moreover, the author’s messages in the book are strong and heartfelt. I recommend this book to every woman who wants a fulfilling life, both at the personal and professional levels.

The Bogleheads’ Guide to Investing: Early on in my journey learning the financial language, I spent hours devouring books on investing. This book and the one next to it, “The Intelligent Asset Allocator“, were two of my favorites. One doesn’t need a finance background in order to understand the concepts and messages presented in these two books. By the time I finished reading them, I felt investing was no longer intimidating. I recall telling my husband, “I can totally do this [participating in the stock market]!”. When you finished reading the books I hope you will share my sentiments about investing, too.

Continue Reading