I convinced my husband to use Personal Capital! In the past five months, I have both subtly and verbally tried to get my husband onboard. This past weekend, he finally gave me the ‘go’ signal. What’s even better? We have been hooked by this financial software the last several days (okay, maybe a bit obsessed). Personal Capital is amazing, beautiful and provides me everything I need (when it comes to understanding my financial life).

I first learned about Personal Capital when I started reading personal finance blogs early this year. Most of my daily reads have written a review about this. Many of them used Personal Capital to track their financial numbers. My eyes were drawn to the colorful and beautiful charts and graphs these bloggers were sharing on their sites. Several of my money savvy friends also started telling me about Personal Capital. I was ready to give it a try.

When I approached my husband with this idea, he blatantly rejected it. He was concerned about the software’s security. He already doesn’t like the fact that we have to login to so many financial accounts to track and manage our finances. He didn’t want another to gain access to our financial data. What if someone would to get hold of our logins and mess with our investment holdings and transactions? What if that were to happen while we’re traveling outside of the country and might not have access to secure Internet? His concerns sounded totally legit to me. After that conversation, I was ready to move on. I accepted the fact that Personal Capital and I weren’t meant to be.

My Obsession

Then, suddenly, I started seeing Personal Capital everywhere on the Internet. Maybe I am exaggerating, but I couldn’t get it out of my head (maybe I didn’t want to). Each passing day was torturing. Every time I read about a *new to me* feature that Personal Capital provides, I wanted to get in. For months, I was admiring this financial software through other bloggers’ monthly financial reports. I wanted to dress up my financial numbers in pretty charts and graphs!

Being fully aware of my husband’s real concerns, I’d have to address them if there was any chance he’d change his mind when I bring this idea to him again. One Saturday while he was out with friends and it was just my daughter and I home, I spent six hours researching and reading everything I could find on the Internet about Personal Capital. I already knew a lot about the features. That day, I mostly focused on learning about its security.

My Secret

The following week, I secretly signed up for a free Personal Capital account. After all I’ve read and heard about Personal Capital, I became personally invested. I needed to get it and take a peek. Once I put in my email and password, I was taken to a stand-alone window where I’d link my financial accounts. I tried to bypass that and get into the main screen, however, I couldn’t find a way. I was very disappointed and ready to close the browser, but I instead played around with my mouse trackball! I did that for about a minute. Finally, I gathered the courage (and took a leap of faith) and put in my bank login and password. Once that was done, I hesitated again. Different voices inside my head started playing tug of war. “I only have a checking and savings account with this bank that I rarely use. I don’t even have that much funds in my checking. What’s the harm even if my information is compromised? Other people who have much higher net worth are using it.” vs. “But your husband doesn’t want you to do this…” Such thoughts went on and on for a while. I finally clicked on the ‘LINK’ button. I betrayed my husband. My heart was pounding fast. Part of me wanted to turn back time and unlink. Part of me was excited.

I started exploring all the features. The graphs and charts were boring. I only provided numbers from one account, what did I expect? I wasn’t going to link another account. I already had enough explaining to do with my husband later that evening. As I continued to browse around, I was looking for an option to manually input some financial numbers. None of the readings I had came across mentioned about this option (everyone talked about linking accounts), but I kept thinking it must exist. And as you guessed, I found the magic words, ‘Manual Investment Holdings’. In the next hour, I was busy manually inputting stock symbols and numbers into my Personal Capital account. Once all that was done, I could finally dress up my financial numbers with beautiful charts and graphs!

My Triumph

When my husband came home from the gym that evening, I told him what happened. I first shared with him the extensive research I had gathered regarding Personal Capital’s security. Then, I told him about the linked bank account and how I managed to find a way to manually input our financial numbers. Finally, I showed him the colorful charts and graphs and all the other fun and useful features/tools we could use to track, analyze and manage our finances. By the time I finished my presentation, my husband was hooked (later, he told me he could see the passion in my eyes as I spoke). And the best part? After we played with the tools/features for a while, my husband excitedly asked me, “How do you feel about actually linking our accounts? Let’s do this for real! It would be a pain in the @SS to have to manually update our transactions every time we make changes”. Of course, my answer was a big “YES”!

*If you want some serious feedback about your financial numbers and financial standing, I recommend you link all your financial accounts. It’s fine using the manual option when you just want to explore the tools/features, however, the software is only as good as the information you put in. If you want a complete picture of your finances, give the tool what it needs so that it can do the job it’s designed to do.

So, What is Personal Capital and How Does Personal Capital Work?

Personal Capital is a financial aggregation software that consolidates information from your financial accounts into one convenient place and provides a holistic view of your financial standing. In order for the software to retrieve your account information, you’d need to specify where each financial account is held, along with the user name or account number and password or PIN for each account. You can always add more accounts later. Your credentials enable Personal Capital to extract the data from those accounts, put it all together, and provide near real-time analysis and insights. According to the website, Personal Capital updates your accounts once every night (around midnight) and then each time you log into the application, up to once per hour. As I mentioned earlier, you also have the option to manually input your financial information, however, I don’t recommend going this route if you’re serious about getting your finances together. If you are concerned about security, you’ll learn more about these features toward the end of this article or click here to jump ahead.

Personal Capital is a two-part package. The free part provides you amazing tools you can use to track, analyze and manage your finances. This includes tracking your income and expenses, loans, mortgage payments and bills. Also available free to you are investment tools that both new and seasoned investors appreciate, such as portfolio performance, and asset allocation. In addition to showing you your real data, Personal Capital also makes recommendations to get your money work harder for you. This software also provides its own retirement planning tool, which allows you to know exactly where you stand relative to your retirement goals. The paid service is Personal Capital’s financial advisory service. In this article, I discuss the free tools and features.

When you sign up to use Personal Capital’s free Dashboard tools, you’re under no obligation to use their paid wealth management services.

THE DASHBOARD

The Dashboard is the first thing you see each time you log into Personal Capital. This area provides a snapshot of your complete financial picture. You can view all your linked accounts in one place, your net worth, your cash flow and your portfolio balances and allocation.

The Left Panel (My Accounts)

The left panel is a static window showing all the financial accounts you’ve either linked and/or manually added. On my screen, I see Cash at the top, then Investment, and then Credit Card. If you have loans and/or mortgages, each would have their own category, too.

When you click on a category, like ‘Investment’, the browser will take you to a new screen listing all the investment accounts you’ve linked. Clicking on any investment account will take you to another new screen showing you all the holdings within that particular account. You can see the number of shares you have, the price and total value.

The Cash Flow Section

The section below Net Worth is Cash Flow. Once you click on this section you can view all your incomes, expenses and transactions associated with your linked accounts. You have the option to view each transaction by category, merchant, or date. With this kind of detailed information, you can make adjustments to improve your overall budget. You can also view your bill payments, too, so you can stay on top of paying your bills. All in all, this section is very similar to Mint’s online interface.

If you’ve done budgeting before, you know that this task can be very time consuming. It’s the reason why my husband and I don’t have a budget (I wrote about what we do instead here). Personal Capital makes tracking your incomes and expenses a breeze. The software takes care of all the calculations for you!

The Portfolio Section

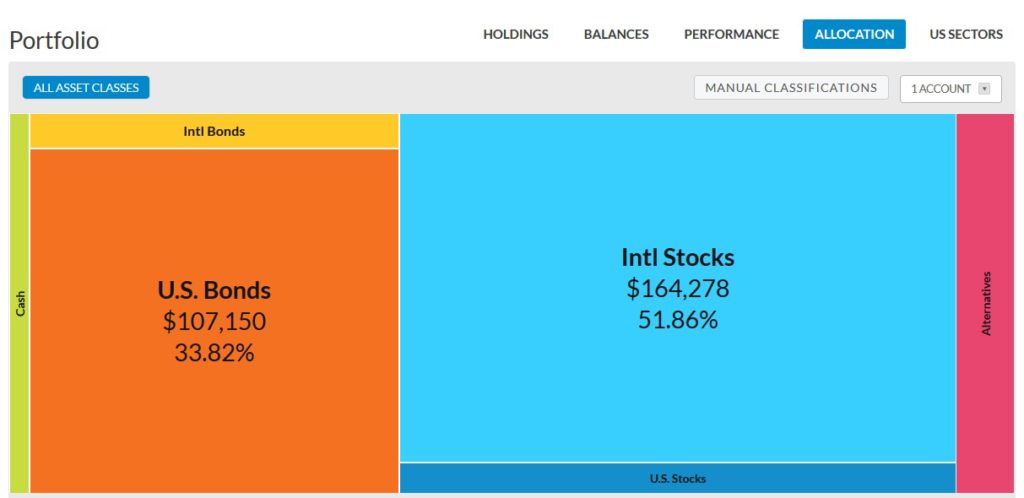

This section is located below Cash Flow. You can also access this information by clicking on the Portfolio tab located on the top of the main screen. This section displays a lot of useful information pertaining to your investments, such as balances, portfolio performance and asset class allocation. The graphs under each subsection aren’t just beautiful to look at. These graphs provide very valuable information in terms of tracking and financial planning. The graphs are interactive, too! Make sure you hover over/ click on each to see additional details (such as clicking on U.S. Bonds or Intl Stocks, see below). You might be surprised at some of the details. This certainly happened to my husband and I. For instance, we had $5,018 of our investments sitting in cash the last time we logged in.

Holdings

This section shows up on the right side of the Dashboard. It’s one of my husband’s favorite features. You can quickly see who are the Top Gainers and Losers of the day. As depicted on the screenshot below, you can view the gains and losses by percentage or dollar amount.

When you click on ‘Holdings’, the software takes you to another screen where you can view how your current overall holdings compare to certain indices, such as the S&P 500, DOW, Foreign Market and Bond Market. Below is a screenshot from our account. Our overall index is lower than that of the S&P 500. A good portion of our investments are muni bonds and the bond market hasn’t done well in November.

ADVISORY TOOLS

The tools available under this section are my favorites. My husband and I can spend hours playing with different scenarios by modifying certain assumptions. We use the Investment Checkup tool, Retirement Planner and Fee Analyzer.

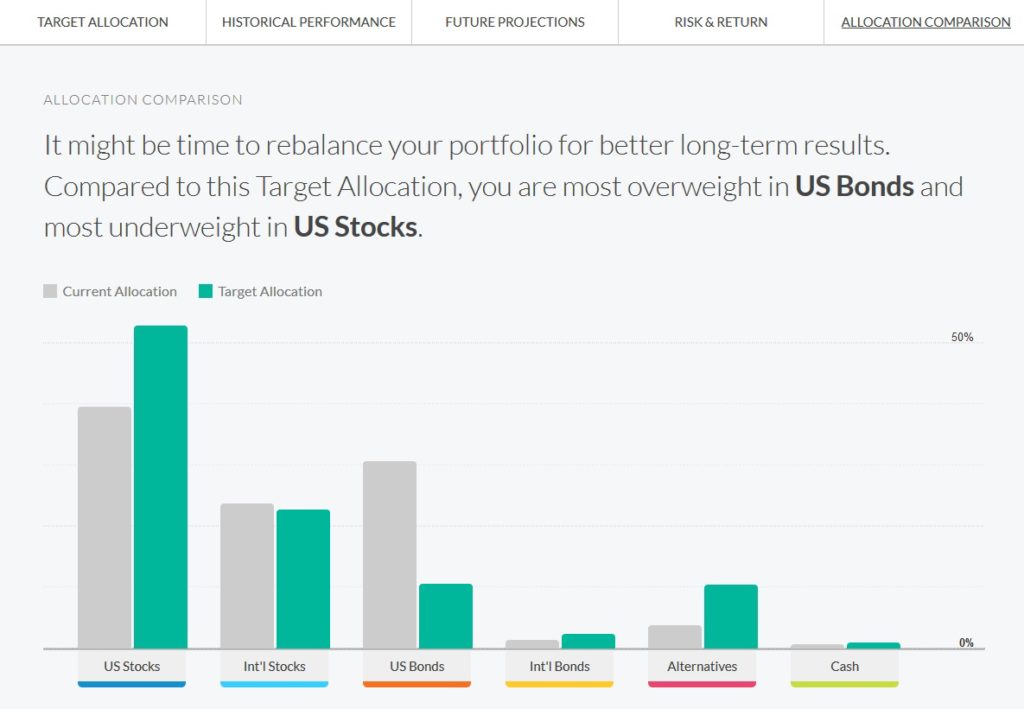

The Investment Checkup Tool

This tool analyzes your investment holdings and provides a risk assessment of your entire portfolio. The tool also analyzes what you’re already invested in (current allocation) and tells you how you could be doing even better (Target Allocation). Personal Capital determines your Target Allocation based on your current investment profile (the software asks you few questions about your savings goals to determine your risk tolerance). The Target Allocation data is intended to help you determine whether a rebalance of your portfolio is wise. My husband and I generally look at these recommendations and mentally play around with different investing strategies. We don’t change up our portfolio based on any recommendations without having done extensive homework on our own.

According to Personal Capital, we should rebalance our portfolio to improve our returns (see below). And the software suggested the Target Allocation for us.

The Personal Capital Retirement Planner

The Retirement Planner is Personal Capital’s way of analyzing your actual financial data from the accounts you’ve linked, assesses your retirement goals and measures whether your financial plan is on track to meet those goals. In order to capture a more complete picture, this tool requires you to provide additional information for Personal Capital to include in its calculations. The screenshot below shows some examples of the kind of information you’d be asked to provide. Planning to pay for your child’s college education? Want to help pay for part or all of your child’s wedding expenses? Put in those numbers and the software will evaluate if you can afford such large expenses and still stay on track for retirement. You can also include income events (like raises and social security payments). Play around with different numbers and scenarios to your heart’s desire. The software will update your retirement forecast each time.

As stated, my husband and I can spend hours playing with different “what-ifs” scenarios. Below is one of many scenarios we played around with.

Retirement Fee Analyzer

Personal Capital’s fee analyzer calculates all the fees that you are currently paying on your investments and how much those fees are going to cost you over time. By default, the Retirement Fee Analyzer selects only non-taxable accounts for analysis (such as Roth, IRA and 401(k)). You can also use this tool with your taxable investment accounts, too. To do so, look for the Account drop down menu near top of browser screen and select all or individual taxable accounts to get analyzed.

This is a great tool for both new and seasoned investors, encouraging us to be aware of all the hidden and expensive fees we often overlook. Some mutual funds within our 401(k)s can be costly thanks to the high management fees. My husband and I are huge advocates of paying low fees when it comes to investing. By itself, a .75% here or one percent fee there may seem harmless. However, let’s put these percentages in context and assume you have a $1 million at retirement and use the 4% withdrawl rule to pay for expenses. In this scenario, one percent in fees would leave you with only three percent to spend. Now, that one percent in fees on $1 million is a $10,000 loss. Ouch! Right? And if you would to stay in the stock market for a period of 20 to 30 years, continuously paying that one percent in fees, you are missing out on a lot of money.

According to the tool, currently my husband and I combined are paying .11% in fees. This number is higher than we’d like. My employer’s 401(k) plan is not competitive as the lowest expense ratio offered is .6%. Personal Capital’s calculator suggested that over the next 20 years (from age 30 to 50), three percent of our projected earnings in our tax-deferred accounts would be lost to fees.

PERSONAL CAPITAL’S SECURITY

In order to provide you a 360 degrees view of your financial life, the software requires you to grant it access to a lot of financial data and private information. And you’ve every right to be skeptical about Personal Capital’s security. As already mentioned, my husband at one point had lots of questions regarding the software’s security features. After having done extensive research in this area, I’m happy to report that Personal Capital is extremely proud of their multiple layers of security. According to their website, the software uses multiple different security systems and processes simultaneously to keep your accounts and your money safe, while keeping your information private.

Two-factor authentication sign in: First, you must register each computer device you are using to sign in to Personal Capital. When you use a new device, the software somehow picks it up and requires you to authorize the new device before you can sign in. Personal Capital will send you either an email or text message to verify. Once a device is registered, you will not need to go through this process again. If someone steals your password and tried to use it from a different device, they cannot get in.

Bill Harris, the CEO of Personal Capital, founded PassMark Security, which designed the online authentication system that is now used by most of the major banks in this country. Mr. Harris also served on the board of directors of RSA Security (one of the largest security companies in the world). He is chairman of XTec, which builds secure identity management systems for the U.S. government. The State Department, the Defense Department and the Department of Homeland Security all use the smart card and biometric security systems developed by XTec in Washington D.C.

Strong encryption: Wondering if your private and financial information are secure with Personal Capital employees? According the company’s website, no individual at Personal Capital has access to any client credentials. Their system is designed such that no employee could pull those credentials even if they tried. All your usernames and passwords are encrypted from your browser or your mobile app to Personal Capital’s systems, and remain encrypted when stored. Personal Capital stated that their website’s encryption is rated A by the world-renowned Qualys SSL Labs, a stronger rating than most major banks or brokerages. Even you can’t move your money in, out, or between any accounts you’ve linked to the dashboard.

Read-only access: If a hacker somehow manages to access your Personal Capital account, the hacker would be able to look at your financial data but not able to touch anything. According to Personal Capital, users can’t actually initiate transactions (such as withdrawals or transfers) from the software. So, if someone actually hacked into your account, he/she/it wouldn’t be able to move any of your money around. In addition, your bank and brokerage credentials are only stored at Yodlee, which is not in Personal Capital’s database. According to Wikipedia, as of 2013, Yodlee has over 45 million users, and over 150 financial institutions and portals (including 5 of the top 10 U.S. banks) offer services powered by Yodlee. In other words, Personal Capital believes that if you can trust your bank and brokerage institutions, you should have the same level of confidence with Personal Capital when it comes to keeping your money and private information safe and secure.

Continuous monitoring: After linking your accounts to Personal Capital, you can use the Transactions page to look at all transactions across all accounts. Personal Capital sends you a daily email (requires opt-in) containing every transaction during the last 24 hours in all your linked accounts — bank, broker and credit card accounts. This feature makes it easy and fast to monitor suspicious activity in your accounts.

IMPROVEMENTS WE’D LIKE TO SEE IN THE FUTURE

Customization

At the time of this writing, we haven’t find a way to manually input incomes, expenses or other transactions. This is somewhat annoying. We spend cash on purchases and services. When we receive gift money we would like to have those money be accounted for (that is, when we choose not to invest that money). In general, Personal Capital does a good job providing us options to customize as needed, however, they do fall short in this area.

Errors While Linking 401(k) Accounts

We found issues in both of our 401(k)s (within the Personal Capital software). First, Personal Capital failed to correctly identify the asset classes in my 401(k) investments. Instead, all the funds within the account got categorized as “Unclassified”, despite it’s obvious that I have international stock and bonds and US mid cap and US large cap. This error messed up my asset class allocations. With that being said, I later noticed that the software does provide ‘manual classifications’ where you can click to go in and manually input asset classes and sectors (depicted below). I appreciate having this option. I suppose it’s not Personal Capital’s fault that a lot of these 401(k) mutual funds don’t have ticker symbols.

Second, two of my five funds got assigned the wrong tickers during the account linking process. And those misassigned tickers don’t reflect the true price of my real holdings. As a result of this, the total value in my 401(k) account (what’s being displayed) in Personal Capital doesn’t match the actual value displayed in my 401(k) brokerage account. I’d rather the software not automatically assign tickers for those funds (and did so incorrectly). At least that’d leave me the option to manually classify the assets as I discussed in the previous paragraph.

As with my husband’s 401(k) account, one of his funds didn’t show up during the linking. That fund has no ticker, and we cannot manually add in the fund. Once again, the true value in his 401(k) is higher than the number showing in Personal Capital.

Why My Husband and I Use Personal Capital to Track and Manage Our Finances

My husband and I combined have 16 financial accounts across 7 financial institutions. That’s a lot to keep track of on a daily or weekly basis. Just several months ago, we were tracking our net worth, portfolio performance and asset allocation like this (see picture below):

![]()

As you can see, we were so dated when it came to using desktop- or app-based financial tools and softwares. We can’t help but think that if we had used any of the available free tools/softwares earlier and tracked our finances, we might be reaching financial independence even sooner. But, we’re using Personal Capital now, and we’re super excited! Several of the free tools are very useful for our current financial situation. We love being able to see all our financial numbers in one snapshot. And when we want more details, Personal Capital breaks them down for us. No more using pencil and paper for my husband when it comes to tracking and managing our finances!

With Personal Capital, we can easily track our net worth, view our investment performance, analyze our asset allocation, see (and minimize) the fees we pay and model our retirement. In a nutshell, we love Personal Capital!

**Disclaimer: This post contains affiliate links, which means that if you click on one of the product links and sign up for an account using my referral ID, I”ll receive the referral bonus. Thank you for helping keep this site running, free of charge to you.**

Like what you’ve read? Subscribe to my free weekly newsletter to receive new post updates every Monday.

steveark

June 12, 2017Great review but I’m still all confused from the part where you care what your husband thought? I’ve been married to my sweet boss, I mean wife, for 39 years and I’m still waiting for that to happen! Well seriously Personal Capital is a great free service. In our case we also have a large chunk of our nest egg under their investing services. They are just as good, so far, at making investment decisions as their free software is at letting you manage your money issues. They charge much higher fees than robo’s but they also have a uniquely diversified portfolio that I think will do better in the sure to come correction/bear market looming somewhere in the future.

Nina

July 6, 2017Thanks for your comment, Steve. Yes, I deeply care about and respect my husband’s thoughts. I don’t and won’t do anything that’d make him feel uncomfortable. And I know he’d say the same in regards to me. This is part of what keeps our relationship strong over the past 7 years of marriage.

With regard to Personal Capital’s investing services, I don’t have much to comment on that as we don’t use them. I did compare their fees with other companies who offer similar services, and agree that theirs are on the higher end. And I do agree that they have a unique way of advertising/promoting their portfolio. Can’t say I necessary agree with their claims, but I did read about the publications. Please come back and share about your experience with them as time goes by.