In Part II of A Woman’s Financial Responsibilities in Her Household, I discuss some of the barriers women face on our way to become financially literate, and how the men (e.g., husbands, fathers, grandfathers, brothers, friends) in our lives can help. In part I, I discussed some gender generalizations regarding how money responsibilities are handled in a typical household and shared some intropsection I have regarding my situation during the earlier years of my marriage.

Women are eager for information about financial planning and investing. In the 2014-2015 Prudential Study, Financial Experience & Behaviors Among Women, 18% of the women surveyed (survey polled 1,407 American women between ages of 25 and 68) said they would like to be more involved in financial decisions that affect them and their households. As another example, Fidelity Investments (Money Fit Women Study, 2015) found 92% of surveyed women (total respondents = 1,542 women ages 18+) wanted to learn more about financial planning, 75% wanted to learn more about money and investing and 83% wanted to get more involved in their finances within the next year. Yet, despite these statistics demonstrating women wanting to get more engaged with our finances, many of us exhibit a great amount of discomfort with our abilities to make wise financial decisions. We’re more confident in the ability of our spouses/partners to assume full financial responsibilities of long-term financial planning than our own.

Barriers to Women’s Financial Competence

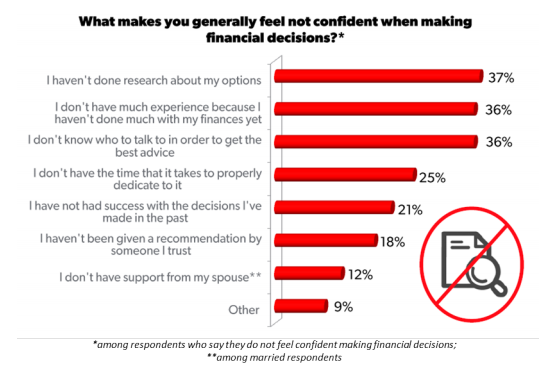

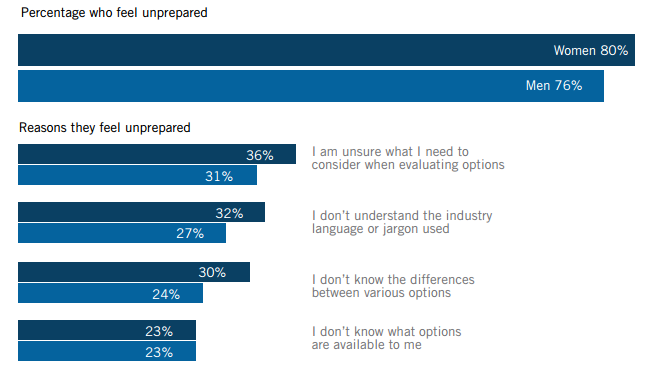

Let’s take a look at some of the reasons women in general feel unprepared or not confident making financial decisions.

Fidelity Investments 2015 Money Fit study:

2014-2015 Prudential study on Financial Experience & Behaviors Among Women:

In sum, the barriers to women’s financial competence tend to fall under the six following categories: (1) lack time, (2) lack financial knowledge, (3) lack trust of the financial industry, (4) lack confidence, (5) lack hands on experience managing money and (6) lack support from spouse. Not surprisingly, few of these barriers are related.

If we can break two or more of these barriers the success rate to increase financial literacy among women is likely to go up. For instance, a woman with a spouse who fully supports her to pursue financial literacy is likely to have more time learning about personal finance and financial planning. The husband would be more likely to take over more household chores so that the wife can pursue her interest. As the woman begins to learn financial literacy, she will learn to read and speak the financial language. In the process doing so, she will learn about the different financial services and products.

As she’s learning she will likely discuss her newly acquired knowledge with her family members and friends. When it’s time to hire a finance professional, this woman will have been well equipped with the knowledge and skills to articulate what she wants and needs, and able to distinguish for herself good and bad professionals. This scenario is my ideal. The steps don’t have to go in this particular order. The information presented here is for you to play around with, and find out what’s best for your situation.

You may ask, where does one begin to seek out information to improve one’s financial literacy? I suggest you follow my blog and my social media, and also check out my Resources page. The Resource page is a work in progress and I update relevant materials.