Your 401(k) can be your vehicle to millionaire status! It promises a lot, doesn’t it? The popular message is that if you begin contributing to your individual account while in your 20s and continue doing so until traditional retirement age, you would become a millionaire and multi-millionaire. The Financial Samurai created a chart illustrating how much you can potentially save in your lifetime. How do you like the numbers?

Yet, navigating the 401(k) process can be complex. Anyone telling you the 401(k) plan is the easiest way to save for retirement still has lots of homework to do. While your employer takes care of some things for you once you opt in, you still need to do a lot on your part to truly maximize the plan’s benefits. If you are willing to put in the time, the work is manageable. You also have access to a lot of free resources and support (such as your HR/employer, your investment brokerage, personal finance books and Online publications).

For many people, having access to a 401(k) plan through an employer might be their first exposure to investing. How can you make such major, long-term decisions when you don’t have much of a clue what the plan is or what choices you have?

In addition to reviewing the plan documents and completing the enrollment paperwork (the form usually asks you to make certain selections), you also need to take a hard look at your financial situation. As the 401(k) is a retirement account, proper planning requires you to think about your timeframe to retirement, your retirement lifestyle and how much money you will need to fund that lifestyle. If you haven’t done this exercise, make good use of this opportunity. This calculator can help you with some numbers.

From there, you also need to assess your current financial situation. Do you have a budget? Do you know what your monthly expenses are? Do you have money in a checking account to pay for reoccurring bills? Have you set aside an emergency fund? After you’ve figured out those numbers, look at your pretax earning and determine how much money you can contribute per pay period.

Once you’ve decided on the amount, it’s time to make investment choices. Many 401(k) plans usually offer an array of investment options. Where do you begin? How do you decide? What’s a good portfolio for your unique situation? When is a good time to make changes? Should you? How do you go about managing your account? Your employer only sponsors the plan. What you do with your individual account is your own business.

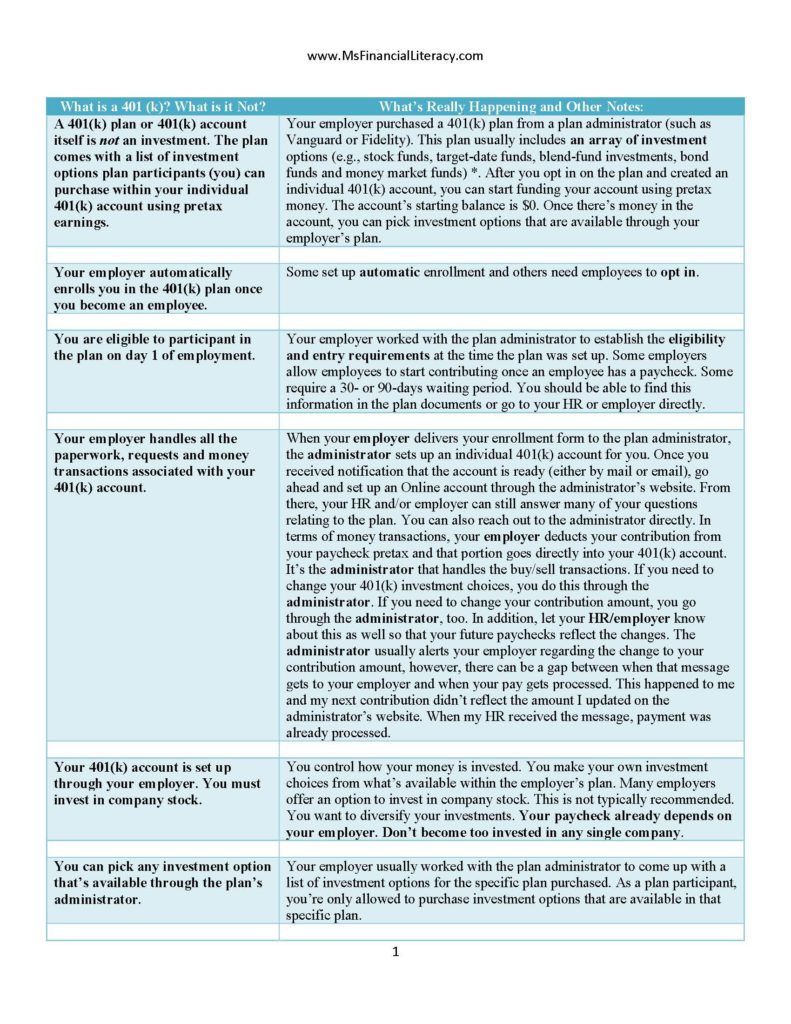

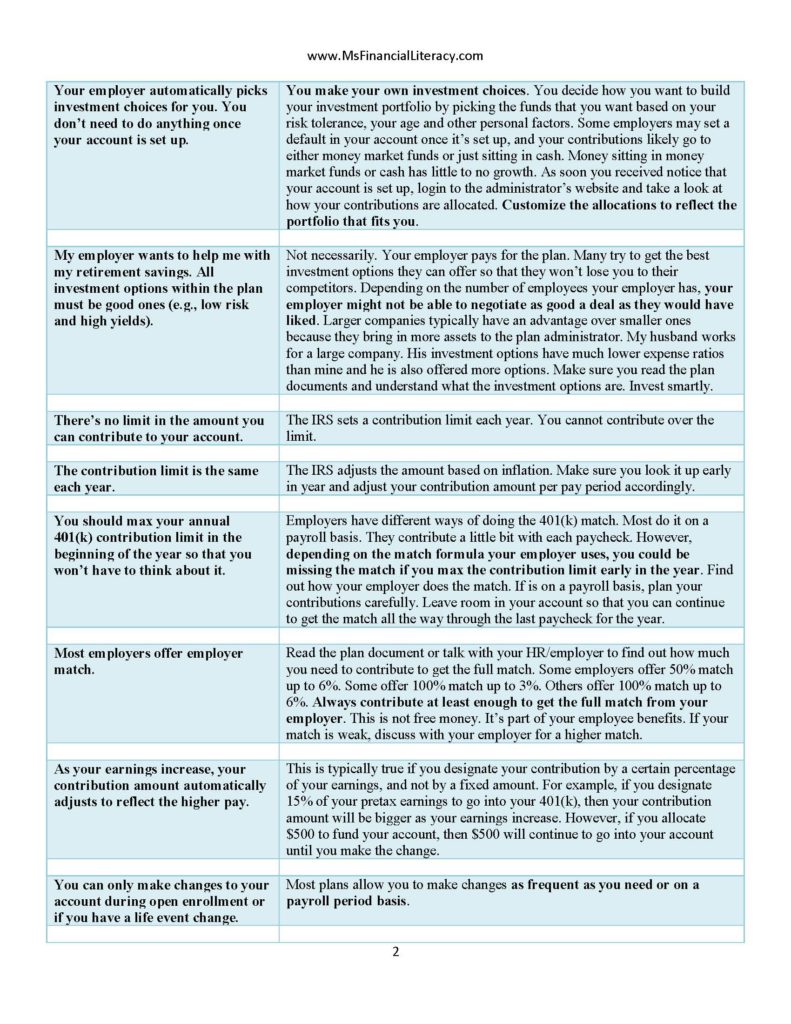

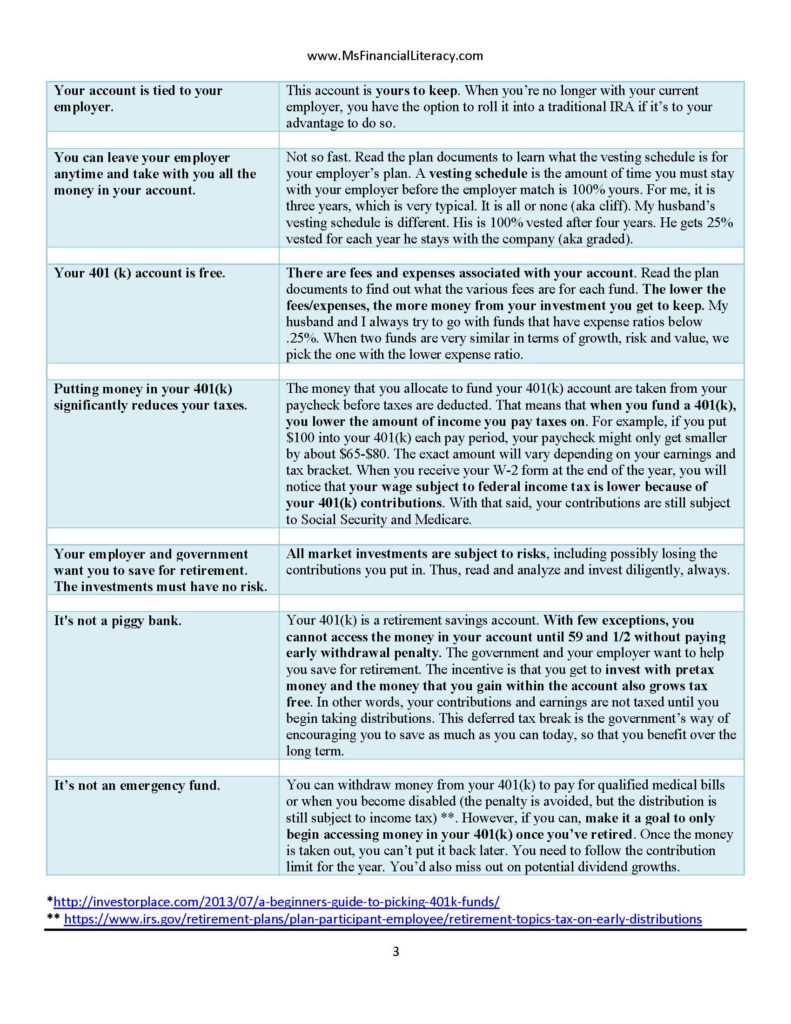

Are you still with me? Feeling overwhelmed? No worries! I’m here to walk you through the process. In the remainder of this post, let’s delve deeper and learn what a 401(k) is and what is not. From my experiences of having talked to a lot of people, I’ve gathered that there are much confusions and misconceptions about the 401(k). To this date, I still bring questions to HR and my husband as I acquire more knowledge.

You can view the following images in another tab/window or in PDF by clicking on this link: What is a 401k? What is it Not? Getting Down to the Basics

In Part II, I shared the strategies my husband and I have used to contribute to our 401(k)s. Contributing to your 401(k) is a form of investment. As we strive to become diligent and prudent investors, it’s worth taking a look at some of the different perspectives investors generally use to contribute to their accounts. What are the advantages and disadvantages?

In Part II, I shared the strategies my husband and I have used to contribute to our 401(k)s. Contributing to your 401(k) is a form of investment. As we strive to become diligent and prudent investors, it’s worth taking a look at some of the different perspectives investors generally use to contribute to their accounts. What are the advantages and disadvantages?

What are some of the first things you learned about the plan?

Anything else you would like to add?

What else are you not clear about?

Does your employer offer a 401(k) orientation for new employees?