When I left my previous employment in early March 2017, I was eager to do a 401(k) direct rollover as soon as possible. In an earlier article, I shared that my 401(k) plan charged relatively high fees. I was also excited to have more control over my investment options. In this article, I’m sharing my experiences doing a 401(k) direct rollover to a traditional IRA. I hope you’ll find this article useful as you go on to learn what’s financially possible for you. I also wrote two comprehensive articles on 401(k) here and here if you’re interested in reading additional materials.

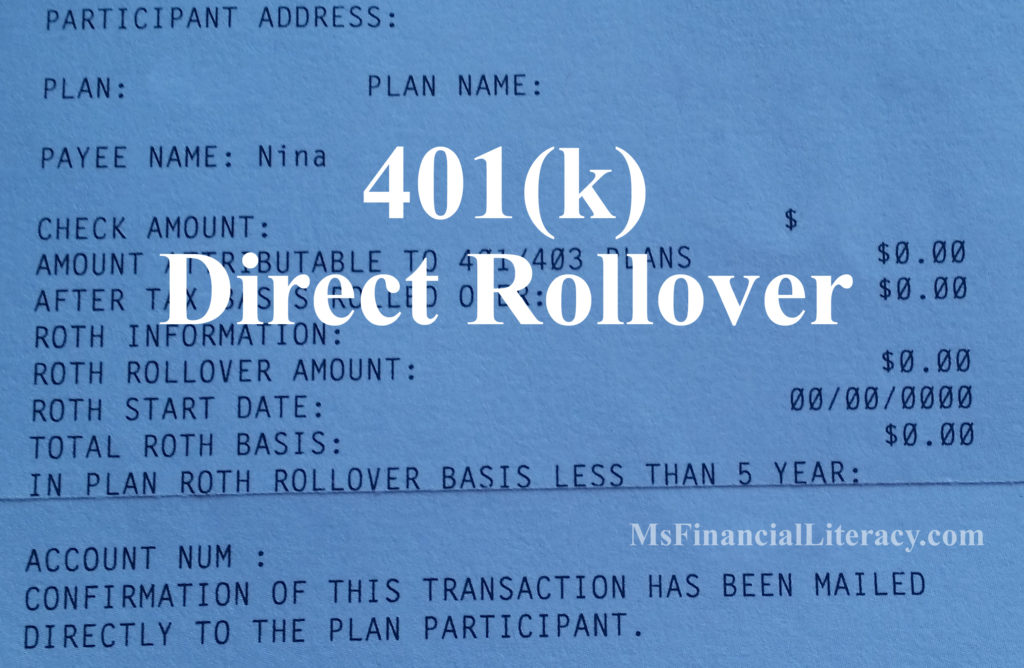

With a direct rollover, the funds are transferred directly from your 401(k) plan to your IRA custodian (or brokerage) and you will not pay an early withdrawal penalty or taxes. The check for the funds is made out to your IRA custodian, not you. For this reason, when you’re ready to do a 401(k) rollover, be sure you’ve already set up a traditional IRA account with the custodian of your choice. Then, when you speak with your previous employer and/or 401(k) plan administrator, be sure to let them know you’re doing a direct rollover and that the check won’t be made out to your name. If the check does get made out to your name, you might have to face taxes consequences immediately. Although you’ll be getting that money back after you filed your tax return (provided you’ve done the rollover correctly and remember to do your tax return correctly), the extra paperwork and hassle are unnecessary. Avoid this while you can. In my case, the check was made “payable to (my brokerage), For the Benefit Of (FBO) of Nina”.

The earliest I could’ve initiated the rollover was sometime in mid March. That was when my last 401(k) contributions and company match were posted to my account. Prior to initiating the rollover, always check with your previous HR and 401(k) administrator to make sure all the money you’re expecting has already been posted to your account.

Due to various family and travel events in March, I actually initiated the direct rollover in mid April. By then, I already had my traditional IRA account set up. When I contacted the 401(k) administrator, I was able to provide her my IRA account number. I suggest you speak with your IRA custodian to find out the exact process you’d need to go through to do the direct rollover. My IRA custodian didn’t voluntarily provide me the details at the time I set up the IRA account. And it didn’t occur to me to ask (yes, they’re always a phone call away). Luckily, my husband did a direct rollover last year and he gave me the specific instructions to share with my 401(k) administrator regarding the funds distribution.

While on the phone with the 401(k) administrator, he alerted me to termination/distribution fees I will be responsible for. Those are fees taken out of my 401(k) account prior to cutting the final check. The sum of those fees came out to be $110. You can always read the “Participant Disclosure” document to learn about the various fees you might have to pay. Luckily, my IRA custodian has a policy in place to reimburse the termination/distribution fees. However, they would not reimburse commission fees (for selling the stocks). My custodian also gave me a nice bonus for bringing my money to them.

When the check arrived at my address, I took the time to verify all the information on the check. As the check was made out to my custodian, I verified that my name on the ‘For the Benefit of” line was correct and that my IRA account number was correct. Once all the information was verified, I brought the check to my custodian on the following morning. The funds were available for trades on the same day.

It took approximately one week from the time I initiated the direct rollover with my 401(k) administrator to the day I received the check. This was how long my funds were out of the market. Once all the funds were reinvested in my traditional IRA, my husband calculated and estimated that I lost about $700 (counting the bonus) while my funds were out of the market. This was a large sum of money. It’s something to be aware of when you go through this process.

While on the phone (or at the office) with your 401(k) plan administrator, ask about the process on their end so you know what to expect. It would be a red flag if you’re told that the process might take several weeks to complete. We certainly don’t know how the market will perform while our funds are out of the market. However, from what I’ve observed and learned of the stock market, the market is more likely to go up than down on any given day. And the market is even more likely to go up than down on any given week. I even asked my 401(k) administrator if I could pay extra money to speed up the mailing of the check. Unfortunately, there was no such option for plan participants. Ultimately, this is a personal choice. In my case, I would’ve lost a lot more money (more than double what I had lost) if my funds had been out of the market for two weeks instead of one.

Your situation may be different than mine. I’m simply sharing my experiences. As always, the contents on this blog are for educational and entertainment purposes only. Be sure to consult a tax or financial advisor for personalized, professional advice (or educate yourself on these topics to determine what’s best for you).

Duncan's Dividends

May 8, 2017I too moved my 401k over as soon as was humanly possible due to taxes Challenges came when I wanted to move the rollover from a rollover at a previous employer. I had 24 shares of MCD, not a lot mind you, that somehow Computershare slapped Farmers Insurance Group as a coowner with me. They never explained why, but I’m just now sorting it out after the better part of a decade. Mostly because it was DRIP and worth so little in the overall scope of my net worth. Either way it’s way better to be in control of your future than to let others control it for you.